Retirement 2025 Limits - 2025 Retirement Plan Limits Qualified Plan Advisors (QPA), The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403. The roth ira contribution limit for 2023 is $6,500 for those under 50, and. The dollar limitations for retirement plans and certain other dollar limitations.

2025 Retirement Plan Limits Qualified Plan Advisors (QPA), The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403. The roth ira contribution limit for 2023 is $6,500 for those under 50, and.

2025 Retirement Plan Contribution Limits, PhaseOut Ranges, and, This note advises private registered providers who own or manage retirement leasehold accommodation of management fee limits for the financial year. 2025 limits and thresholds for qualified retirement plans.

2025 Retirement Plan Limits HRPro, Only 31% of people feel they are saving enough for retirement, according to the federal reserve. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

IRS announces higher retirement account contribution limits for 2025, The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403. Christine benz dec 15, 2023.

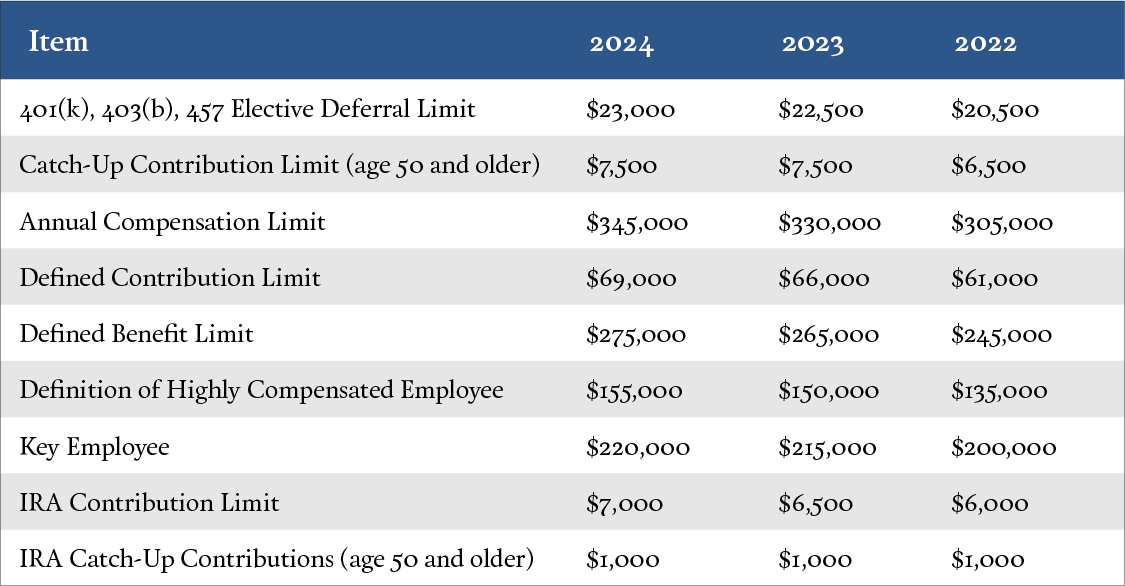

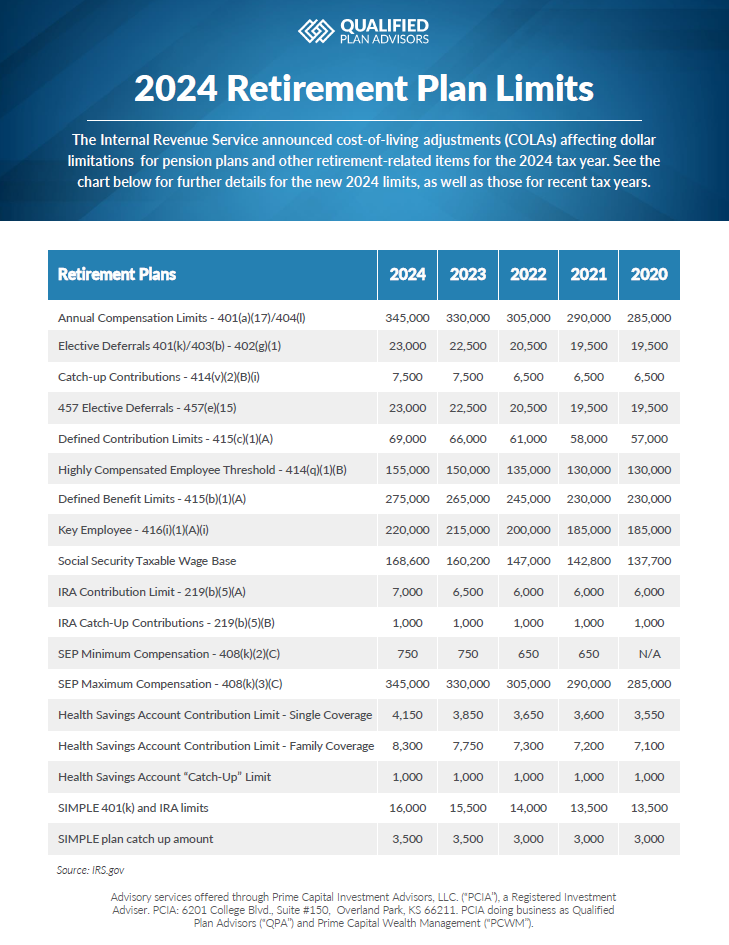

What’s New for Retirement Saving for 2025?, 401 (k) pretax limit increases to $23,000. Other key limit increases include the following:

Contribution limits for 401 (k)s, 403 (b) s, 457 (b)s, iras, roth iras, hsas,.

Treasure Fest San Francisco 2025. Joe cahn, the late ‘commissioner of tailgating’ and new orleans school of cooking founder, suggested…

When Will Irs Announce 401k Limits For 2025 Cindy Deloria, Contribution limits for 401 (k)s and other defined contribution plans: The dollar limitations for retirement plans and certain other dollar limitations.

2025 Contribution Limits Announced by the IRS, Contribution limits for 401 (k)s and other defined contribution plans: Ira contribution limits for 2025.

Retirement 2025 Limits. Only 31% of people feel they are saving enough for retirement, according to the federal reserve. 2025 limits and thresholds for qualified retirement plans.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10%. To make sure you don't put your retirement savings on the back burner, consider either having the money deducted from your.